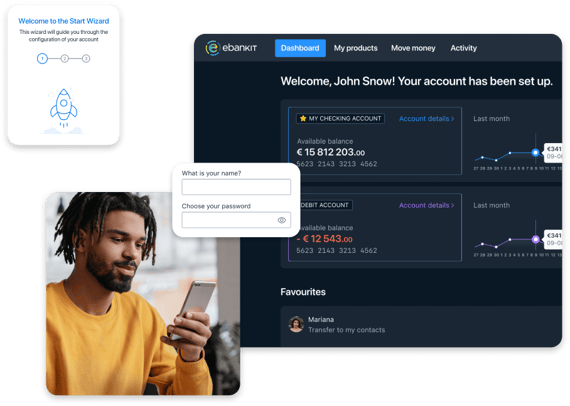

Humanizing Digital Banking

Supporting financial institutions to build long and meaningful relationships. A personalized experience across every digital banking channel.

Digital banking that is emotional - not robotic

ebankIT brings the human connection to the daily banking lives of millions of users. Discover an omnichannel platform with a customer-centric approach that fosters collaborative relationships and empoweres banks and credit unions to future-proof their business strategy.

Innovate fast and do differently with a new digital banking experience

innovation

We help financial institutions to future-proof their business strategy. Based on a disruptive innovation roadmap, ebankIT offers a wide range of digital tools: from artificial intelligence to machine learning, from voice banking to biometrics authentication.

to market

To build or to buy? That's the question most financial institutions face. At ebankIT, we believe that there is an ideal middle-ground solution: a ready-to-market platform with increased product adaptability.

swipe of a finger

ebankIT’s modular architecture enables each financial institution to choose the solution that best suits their goals. ebankIT Studio and ebankIT Management System give each client the opportunity to continuously adapt.

ebankIT Omnichannel Digital Banking Platform

ebankIT Omnichannel Digital Banking Platform

ebankIT Omnichannel Digital Banking Platform

ebankIT Omnichannel Digital Banking Platform

ebankIT Omnichannel Digital Banking Platform

ebankIT Omnichannel Digital Banking Platform

ebankIT Omnichannel Digital Banking Platform

The founding stone. With pre-built connectors, this layer builds the bridge between any core banking system and the ebankIT platform.

The heart and soul of our Platform. ebankIT is prepared to run on an out-of-the-box basis, accelerating deployment and the digital shift.

Banks and credit unions enjoy the freedom to generate new services in-house, with low amounts of coding and reduced costs.

The backstage of a memorable performance. Back office channels enable financial institutions to fully manage every business detail.

Digital banking anywhere, in real time and across every channel: Web, Mobile, Wearable Gadgets and even more – the Metaverse.

Explore every tool to engage with your audience: from the branch front office to a contact center and a new customer management center.

ebankIT API Gateway connects financial institutions with a growing ecosystem of partners that provide complementary technologies

ebankIT Omnichannel Digital Banking Platform

The founding stone. With pre-built connectors, this layer builds the bridge between any core banking system and the ebankIT platform.

ebankIT Omnichannel Digital Banking Platform

The heart and soul of our Platform. ebankIT is prepared to run on an out-of-the-box basis, accelerating deployment and the digital shift.

ebankIT Omnichannel Digital Banking Platform

Banks and credit unions enjoy the freedom to generate new services in-house, with low amounts of coding and reduced costs.

ebankIT Omnichannel Digital Banking Platform

The backstage of a memorable performance. Back office channels enable financial institutions to fully manage every business detail.

ebankIT Omnichannel Digital Banking Platform

Digital banking anywhere, in real time and across every channel: Web, Mobile, Wearable Gadgets and even more – the Metaverse.

ebankIT Omnichannel Digital Banking Platform

Explore every tool to engage with your audience: from the branch front office to a contact center and a new customer management center.

ebankIT Omnichannel Digital Banking Platform

ebankIT API Gateway connects financial institutions with a growing ecosystem of partners that provide complementary technologies

Cloud banking: ebankIT is ready for the future

Cloud-based banking is not a distant prediction. ebankIT’s modular architecture is ready for different infrastructure systems, enabling banks and credit unions to get additional flexibility, scalability and resilience, while reducing costs.

Digital banking solutions for every business strategy

Retail Banking

Banking customers worldwide are flocking to digital channels. Create meaningful experiences through every banking channel and match the changing expectations of a new generation.

Business Banking

Managing multiple accounts, handling large volumes of transactions, and addressing unique requirements can present significant challenges for banks. ebankIT offers a full suite of features designed to optimize every aspect of commercial banking.

Our customer satisfaction speaks for itself

Some of the world’s top banks and credit unions have already implemented ebankIT. Find out why they trust us.

In ebankIT we have found a partner that allows for a flexible and agile development. Within a very short time, less than 3 months, we were able to provide an e-banking service that met our expectations.

CEO

Our partnership with ebankIT has been instrumental in bringing our vision of a cutting-edge digital banking solution to life. Together, we've redefined convenience, security, and accessibility in banking.

President & CEO, Coast Capital Savings

It’s frictionless, seamless, and very swift in terms of delivery. It’s complicated technology, delivering simple customer outcomes.

Former Chief Operating Office

We can clearly see that we have more customers and the customers that we have are transacting more. They are engaging more, and the adoption of the new platform has been even faster than we thought. In less than 2 weeks, we already had close to 25% of customers migrated into the new platform.

FNB’s Chief Digital and Information Officer

ebankIT in numbers

12

Countries

ebankIT Platform is deployed in 12 countries and 5 continents

+20

Million users

More than 20 million users interact with the ebankIT platform everyday

14 +

Core Systems

ebankIT is pre-integrated with 14 main transactional core banking systems

.webp?width=516&height=206&name=Partners_integrators-10%202%20(1).webp)

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)