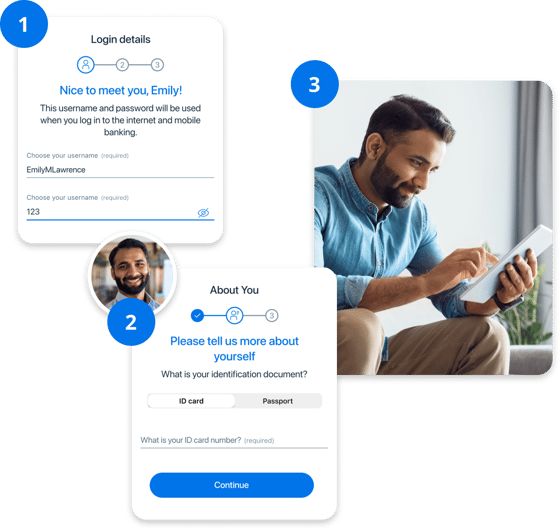

Instant digital account opening & onboarding

Acquire more account holders and quickly drive deposit growth through digital channels. Simplify the registration process to provide a smooth and hassle-free onboarding experience for customers, significantly reducing wait times and enhancing client retention.

Unveil the secrets behind smooth digital onboarding and discover how ebankIT technology can propel your institution forward in the digital age.

Increase deposit growth with a mobile-first fast digital account opening solution that reduces abandonment while building lasting relationships with account holders.

Unlock efficiency with robust KYC, document generation, and instant identity verification. ebankIT multi-layered security ensures a swift and secure process.

Offer users the convenience of managing their current and saving accounts in one single place thanks to ebankIT’s PSD2's account aggregations services.

Reduce operational costs and friction by seamlessly transferring data between your core banking and digital channels. Enable instant account registration without any manual entry.

Metropolitan Commercial Bank's rapid digital onboarding success

Our client Metropolitan Commercial Bank was recognized with the Editor’s Choice Award for its digital onboarding solution at the Banking Tech Awards USA.

Instant digital account opening

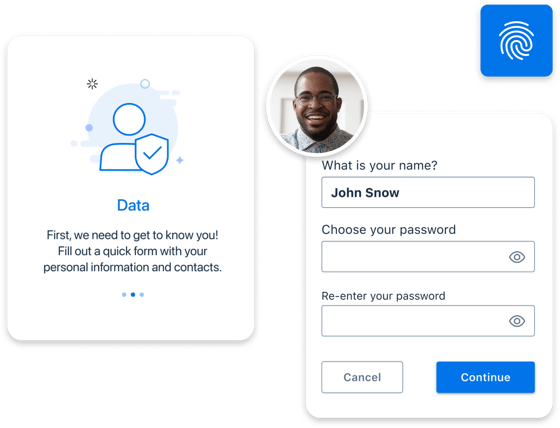

Enhanced identity verification

Elevate your security protocols by implementing powerful, automated Know Your Customer (KYC) procedures and identity verification solutions, including Anti-Money Laundering (AML) software.

Utilize sophisticated data analytics, biometric verification, and live transaction surveillance to create an in-depth profile for each user, identifying any irregularities that may suggest fraudulent activities.

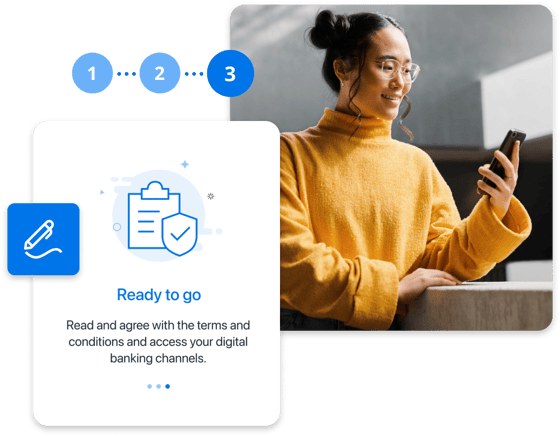

Fast and seamless digital account opening

Maximize conversions with a mobile-first onboarding approach that prioritizes speed and convenience. Streamline account approval processes and enable e-signatures so that customers can swiftly complete their digital onboarding in minutes.

Enhance client satisfaction and retention by ensuring a frictionless experience for both customers and institutions alike.

One-stop card hub for cards & wallets

Empower your clients by centralizing the management of their credit, debit, and prepaid cards all in one place. Enable them to monitor account details, track card activity, and examine each transaction associated with their diverse card accounts.

Users can easily update personal info, adjust security settings, or cancel cards in a straightforward three-step process.

Drive deposit growth

ebankIT Digital Account Onboarding solution offers a seamless, multi-product onboarding experience, empowering banks to cater to diverse funding needs such as new account deposits or loan disbursements.

Enable your customers to immediately benefit from their new products with initial funding options for account activation or joining the credit union.

Digital banking app

Cut down on operational expenses and reduce hurdles by effortlessly integrating data from your app directly into the core system. Implement instant account setup with streamlined automation, eliminating the need for account holders to enter data again.

Empower your account holders to download your digital banking app and experience immediate registration without the need for manual input.

Key features

recognition

integration

integration

digitalization

Boost digital sales with personal financial management

Digital Concierge

The ebankIT Digital Concierge takes Personal Financial Management to another level. Powered by Artificial Intelligence, the mobile app provides personal notifications and creates financial suggestions especially curated to match each customer’s preferences.

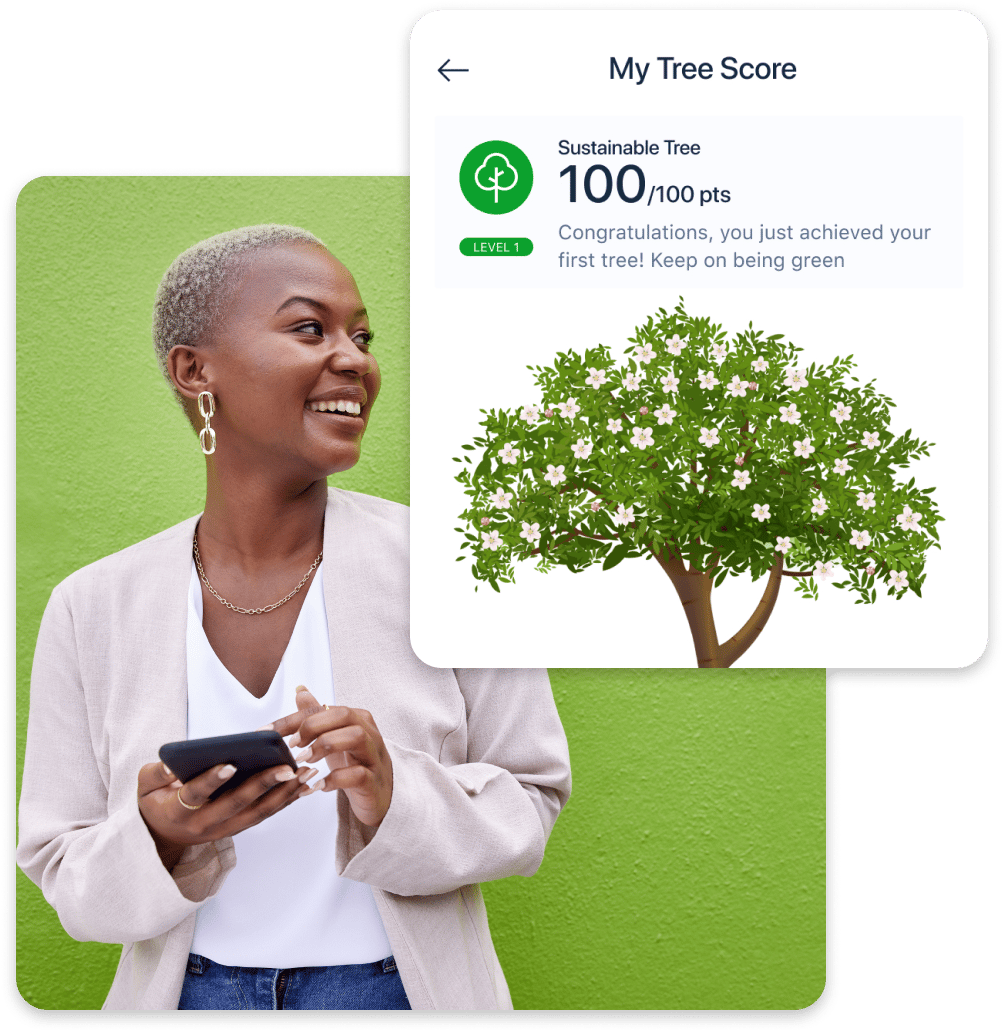

Goals selection & gamification for banking

ebankIT enables banks and credit unions to increase customer engagement using game mechanics. Banking customers are invited to enjoy enjoyable gameplay, where they can collect points by achieving their self-selected goals. In the end, points are transformed into tailor-made rewards.

Take advantage of an ever-growing network of partners

ebankIT Omnichannel Plaftorm is enhanced by a comprehensive ecosystem of partnerships that provide complementary technologies and banking solutions

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)