Seize the digital advantage: transform your business banking experience

Embrace a revolutionary banking platform that caters to the diverse needs of business leaders across industries, regardless of their digital expertise or financial goals.

ebankIT digital banking solution is set to transform the customer journey of SMEs and business banking clients while offering tailored experiences with unparalleled flexibility and speed to market.

Companies benefit from a proactive banking approach that leads them to seize the best financing offers and to stay ahead of the competition.

After a quick deployment process, corporate banks can continuously tailor their offer and generate new services according to their target audience.

Relying on a modular architecture, ebankIT provides continuous releases and updates, matching the growing demands of corporate banking.

A digital platform for a new generation of business leaders

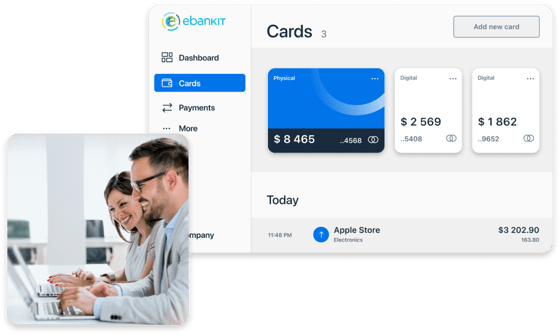

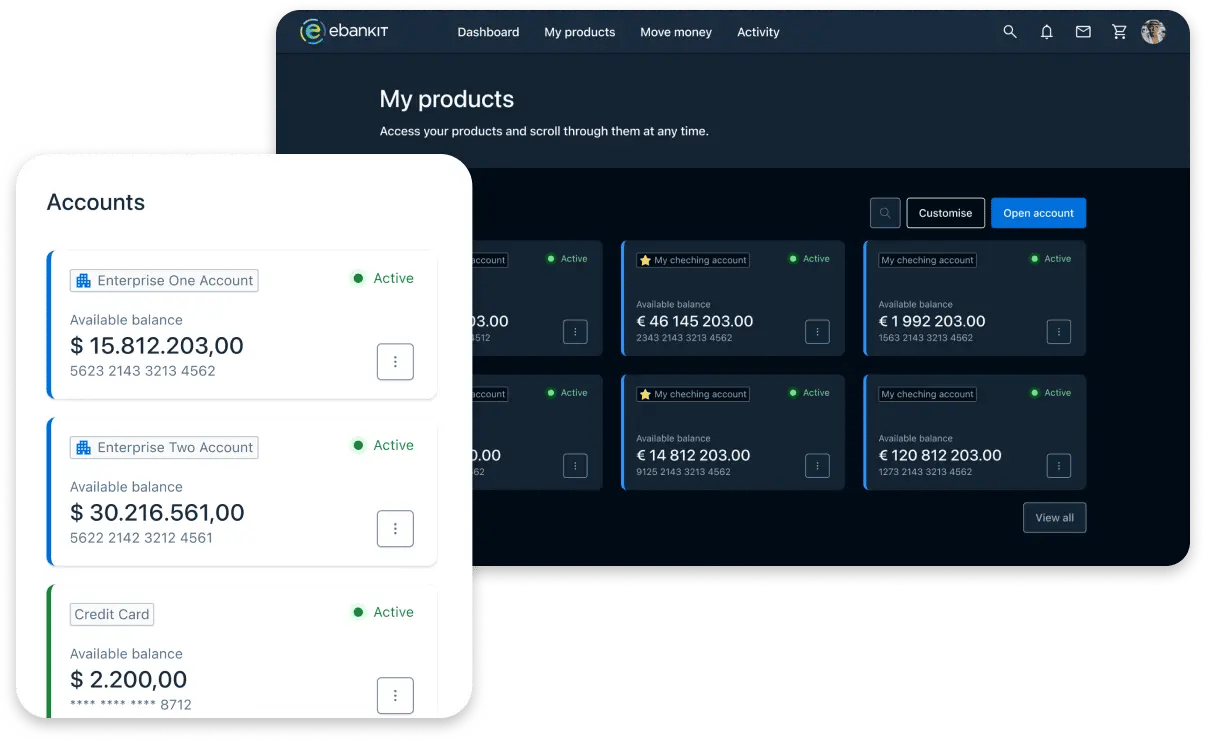

A single platform, multiple accounts

Empower business leaders to effortlessly navigate between multiple accounts, optimize cash flow, and monitor expenses. Consolidate multiple deposit accounts or legal entities under one roof, enabling businesses to monitor subsidiaries efficiently. Say goodbye to multiple logins and hello to profile switching.

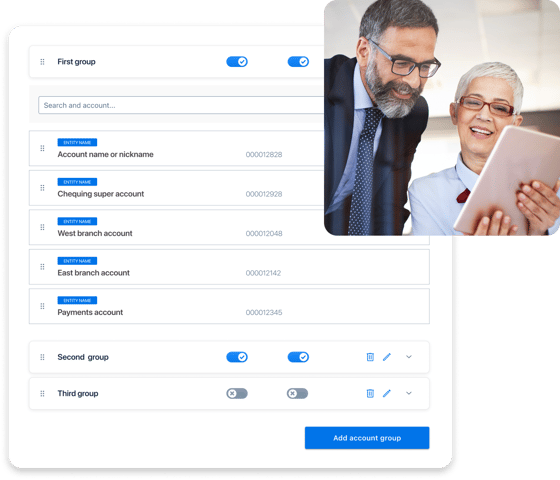

Streamlining business permissions safely

Experience easy and simple control over user access and permissions. With the Entitlement Management feature, businesses can create delegates, reset passwords, and adjust permissions with full authority. Empower business administrators to set transaction limits for delegates, create rules and manage access, enhancing agility while alleviating bank staff workload. Embrace efficiency and precision like never before.

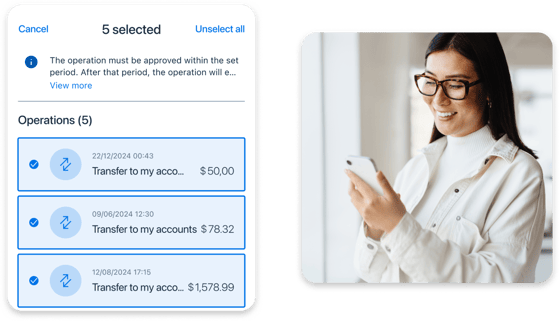

Save time with automated billing

Optimize business processes with bulk approval operations like payroll, centralize workspace for templates and transactions, and save time with automated billing for smooth processes.

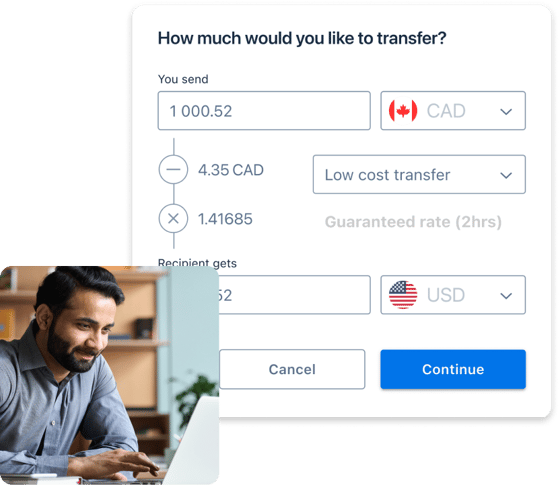

Best-in-class payments and secure transactions

Provide expedited payments, seamless wire transfers (domestic and international, including foreign currency), and integrated bill payment with centralized user entitlements. Strengthen payment security and mitigate risks through comprehensive risk assessment reporting, coupled with real-time detection and prevention of payment fraud using positive pay mechanisms.

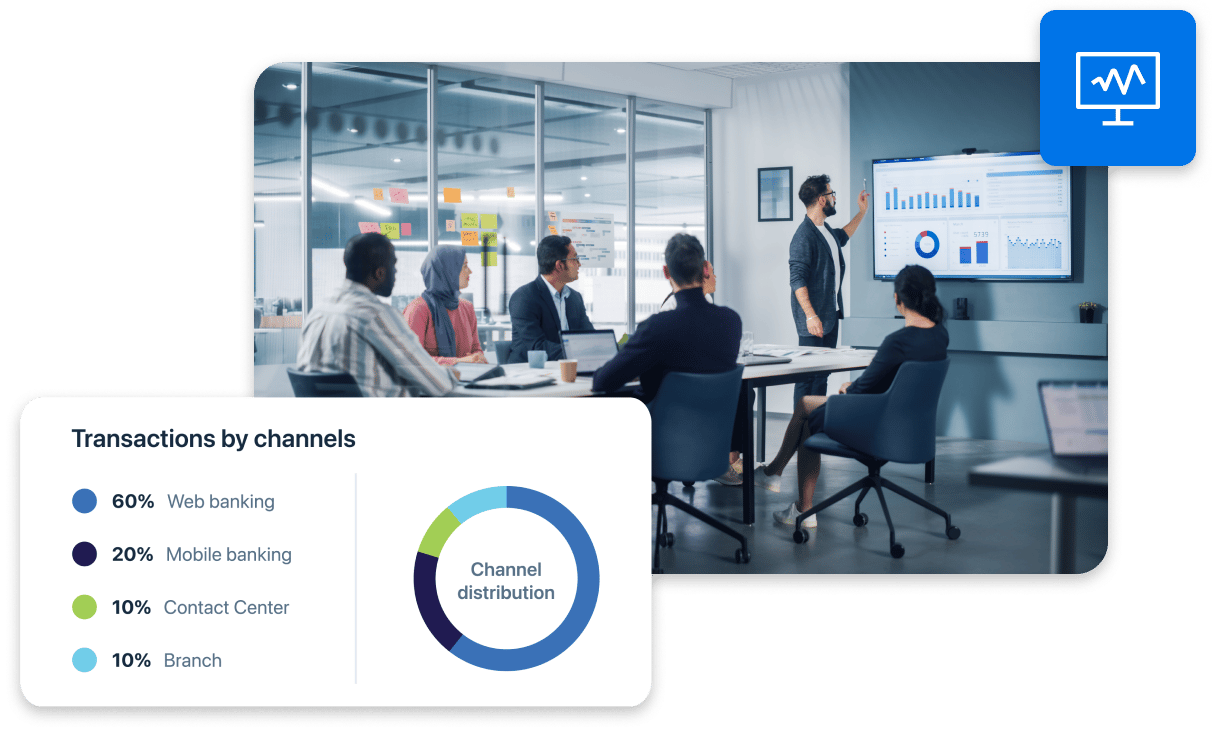

Forecast, plan, and succeed

Enable enterprises with user-friendly dashboards for accurate forecasting, budgeting, and strategic decision-making, integrated with accounting systems and manage transaction limits easily and securely.

Tackle security threats and prevent fraud

Simplify your compliance journey with comprehensive security measures that not only prevent payment fraud but also enhance transaction security thanks to ebankIT’s SOC 2 certification. From embedding security protocols in software development to conducting audits and risk assessments, ebankIT’s Privacy Program ensures GDPR compliance for all data processing. Also, protect your business customers from checks and payment fraud with an integrated positive pay and account reconciliation solution.

.webp?width=560&height=341&name=Tackle-security-threats-and-prevent-fraud%20(2).webp)

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)