The omnichannel banking platform of the future

Every banking channel and feature is set together in one single platform, enhanced with the most innovative and customer-centric approach. ebankIT is an Omnichannel Digital Banking Platform, ready to integrate with any core system, and focused on creating an interactive digital experience.

Financial Institutions future-proof their strategy while customers enjoy the best user experience throughout every stage and touchpoint.

The four dimensions of our digital banking platform

Create new customer journeys, tailored to fulfill each user’s priorities and preferences

composability

Select and implement only the modules that suit your business strategy

agnostic

Benefit from an agnostic platform, that easily integrates with any core system

Enjoy the disruptive ebankIT Studio and implement changes without requiring additional IT support

We are always cutting the time-to-market

It's not like this is a race, but we are proud to offer a quick solution. We have clients where the platform was fully implemented within 6 months. Let’s beat this time on the next sprint!

and launching new products

Engage in a pioneering innovative roadmap, with new product launches and updates every six months. Our partners are also always launching new features and enhancements.

to future-proof your digital sales

From Gen-Z onwards. ebankIT’s customer-centric approach matches the growing demands of a new generation of banking users.

Let's deep dive into our online banking platform

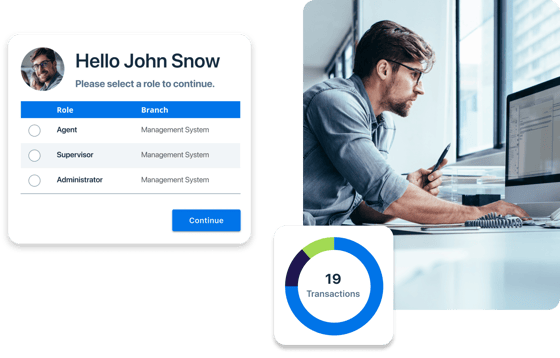

Keep your business running lean

Back office channels act as the control room of the entire omnichannel experience. Banks and Credit Unions enjoy the necessary leverage to customize and administrate with all business information, without requiring additional support from IT teams.

Establish a better experience for your teams, by taking benefit from a wide range of digital tools. From the Monitoring Center to the ebankIT Management System, banks and credit unions can easily administrate end-users and create transactional workflows based on their digital strategy.

Separation of responsibility

Autonomous marketing tools

Real time usage monitoring

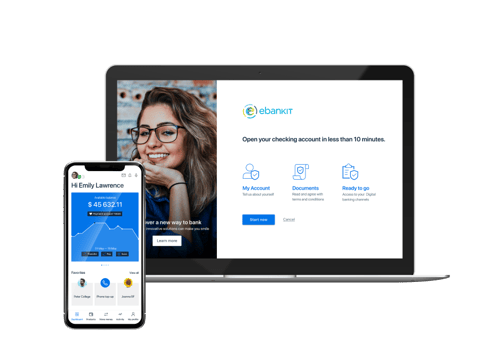

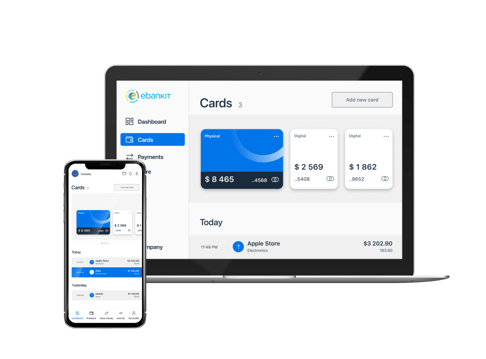

Digital banking anywhere, in real time and on every device

There is no doubt: the future of banking is omnichannel. Combining a customer-centric approach with a genuine multichannel strategy, ebankIT turns every offer into an enjoyable journey, where customers are free to use their device of choice and switch to another at any given time.

Loans, payments, transfers, cards, opening accounts, and even a complete process of onboarding: every feature is just a fingertip away, either through internet or mobile banking, on every possible gadget, including wearables, or even entering new virtual worlds – like the metaverse!

Easy and accessible banking

Customizable user experience

Powered with leading analytics tools

Staying close to every customer in a new digital era

ebankIT enables banks and credit unions to explore every digital tool to engage with their customers and members. The frontoffice layer is designed to centralize every activity on both the banking branch and the contact center, as well as creating new ways to contact customers.

Emails, chats, calls, IVR customer service and more: every effort is integrated in a single platform, enabling the banking team to monitor every customer interaction, plan future campaigns and identify emerging opportunities in any given market.

Branch and Call Center in a single platform

Powered with a Customer Management Center

Focused on boosting customer retention

Keep your business running lean

Back office channels act as the control room of the entire omnichannel experience. Banks and Credit Unions enjoy the necessary leverage to customize and administrate with all business information, without requiring additional support from IT teams.

Establish a better experience for your teams, by taking benefit from a wide range of digital tools. From the Monitoring Center to the ebankIT Management System, banks and credit unions can easily administrate end-users and create transactional workflows based on their digital strategy.

Separation of responsibility

Autonomous marketing tools

Real time usage monitoring

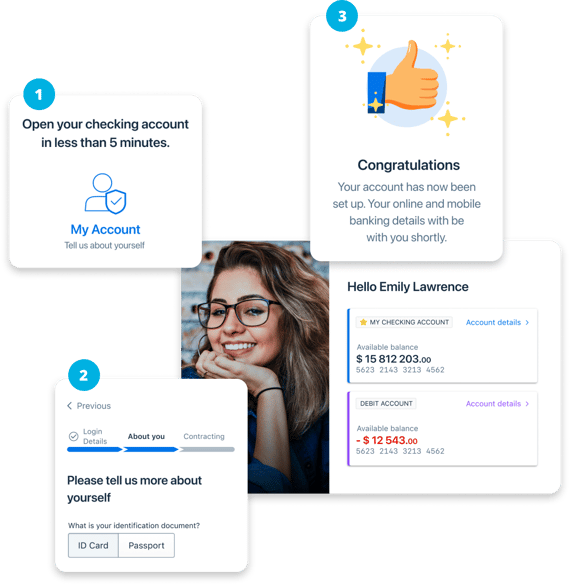

Digital banking anywhere, in real time and on every device

There is no doubt: the future of banking is omnichannel. Combining a customer-centric approach with a genuine multichannel strategy, ebankIT turns every offer into an enjoyable journey, where customers are free to use their device of choice and switch to another at any given time.

Loans, payments, transfers, cards, opening accounts, and even a complete process of onboarding: every feature is just a fingertip away, either through internet or mobile banking, on every possible gadget, including wearables, or even entering new virtual worlds – like the metaverse!

Easy and accessible banking

Customizable user experience

Powered with leading analytics tools

Staying close to every customer in a new digital era

ebankIT enables banks and credit unions to explore every digital tool to engage with their customers and members. The frontoffice layer is designed to centralize every activity on both the banking branch and the contact center, as well as creating new ways to contact customers.

Emails, chats, calls, IVR customer service and more: every effort is integrated in a single platform, enabling the banking team to monitor every customer interaction, plan future campaigns and identify emerging opportunities in any given market.

Branch and Call Center in a single platform

Powered with a Customer Management Center

Focused on boosting customer retention

Easy to implement and ready to connect with every core system

The ebankIT Integration Layer is the getaway that enables banks and credit unions to quickly implement the ebankIT platform. With pre-built connectors, it easily integrates with all the main core-banking systems, building the bridge between the core banking or legacy systems and the ebankIT Middleware.

Flexible and fully-agnostic, ebankIT is able to help every financial institution, regardless of their size or background, reach their full potential and providing an increasingly innovative and humanizing experience.

Easily connects with main core systems

Flexibility to integrate with custom services

Locally adapted to different markets

The heart and soul of ebankIT Platform

ebankIT Business Layer runs on an ready to use basis, enabling ease of deployment and the overall increase in digital sales. ebankIT is based on a comprehensive catalog of middleware tools, that range from Communication Gateways to a robust Security Center, from a Consent Management Center to a Notification Engine.

ebankIT turns complex procedures in simpler opt-in and opt-out actions, shielding the banking team from unnecessary and repetitive tasks.

Focus on core business

Consistent development

Less time spent on secondary tasks

A gateway to endless innovation

While affirming itself as a reliable and robust digital banking platform, ebankIT also takes benefit from a growing ecosystem of partners, that provide complementary technologies to grant every financial institution a state-of-the-art solution.

The ebankIT API Getaway opens the door for the integration of third-party solutions, as well as providing PSD2 compliance, offering banks and credit unions an endless roadmap of innovation.

Integration with leading fintech solutions

Flexible marketplace with a modular approach

Enabling financial institutions to build their solution

Keep your business running lean

Backoffice channels act as the control room of the entire omnichannel experience. Banks and Credit Unions enjoy the necessary leverage to customize and administrate every business information, without requiring additional support from IT teams.

Establish a better experience for your teams, by taking benefit from a wide range of digital tools. From the Monitoring Center to the disruptive ebankIT Management System, banks and credit unions can easily administrate end-users and create transactional workflows based on their digital strategy.

Separation of responsibilityAutonomous marketing tools

Real time usage monitoring

Easy to implement and ready to connect with every core system

The ebankIT Integration Layer is the getaway that enables banks and credit unions to quickly implement the ebankIT platform. With pre-built connectors, it easily integrates with all the main core-banking systems, building the bridge between the core banking or legacy systems and the ebankIT Middleware.

Flexible and fully-agnostic, ebankIT is able to help every financial institution, regardless of their size or background, reach their full potential and providing an increasingly innovative and humanizing experience.

Easily connects with main core systems

Flexibility to integrate with custom services

Locally adapted to different markets

The heart and soul of ebankIT Platform

ebankIT Business Layer runs on an ready to use basis, enabling ease of deployment and the overall increase in digital sales. ebankIT is based on a comprehensive catalog of middleware tools, that range from Communication Gateways to a robust Security Center, from a Consent Management Center to a Notification Engine.

ebankIT turns complex procedures in simpler opt-in and opt-out actions, shielding the banking team from unnecessary and repetitive tasks.

Focus on core business

Consistent development

Less time spent on secondary tasks

A gateway to endless innovation

While affirming itself as a reliable and robust digital banking platform, ebankIT also takes benefit from a growing ecosystem of partners, that provide complementary technologies to grant every financial institution a state-of-the-art solution.

The ebankIT API Getaway opens the door for the integration of third-party solutions, as well as providing PSD2 compliance, offering banks and credit unions an endless roadmap of innovation.

Integration with leading fintech solutions

Flexible marketplace with a modular approach

Enabling financial institutions to build their solution

Keep your business running lean

Backoffice channels act as the control room of the entire omnichannel experience. Banks and Credit Unions enjoy the necessary leverage to customize and administrate every business information, without requiring additional support from IT teams.

Establish a better experience for your teams, by taking benefit from a wide range of digital tools. From the Monitoring Center to the disruptive ebankIT Management System, banks and credit unions can easily administrate end-users and create transactional workflows based on their digital strategy.

Separation of responsibilityAutonomous marketing tools

Real time usage monitoring

Less coding, more freedom

With the ebankIT Platform, banks and credit unions are able to generate new services in-house, with low amounts of coding and reduced costs. ebankIT Studio is an omnichannel Integrated Development Environment (IDE) that offers comprehensive customization tools, enabling each financial institution to continuously adapt and reshape their digital portfolio and business strategy.

Discover a next generation banking platform that can do both

Flexible and always responsive to change, ebankIT offers a steady stream of innovations, tailor-made to match the complexities of both retail and corporate banking.

Retail banking

Loans, payments, transfers, cards, opening new accounts and much more. Discover the most innovative and personalized multichannel experience for banking customers of any age, background or level of experience.

Business banking

Designed with extensive multi-user and multi-currency capabilities, ebankIT helps banks and credit unions to provide the best guidance and widest portfolio for corporate and SME’s across every banking channel.

World-class technology, locally adapted

To further accelerate delivery, ebankIT has also developed custom regional layers containing functionalities specific to each country or to distinctive banking principles.

Canada Layer

For Canadian banks and credit unions, ebankIT has developed a specific module that addresses not only the mandatory, but also other key requirements of the local market.

Islamic Banking

Stepping into the Islamic world, ebankIT enables financial institutions to easily apply all the Islamic Banking requirements. From Zakat donations to right-to-left script, ebankIT easily complies with all the Shariah banking principles.

Take advantage of an ever-growing network of partners

ebankIT Omnichannel Plaftorm is enhanced by a comprehensive ecosystem of partnerships that provide complementary technologies and banking solutions

Want to know more? Ask for a demo and discover the capabilities of ebankIT Omnichannel Platform

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)