Secure multifactor authentication, mobile app protection & penetration testing

Protect digital banking with a secure and robust platform built for financial institutions. Our solution combines passwordless MFA, mobile app shielding, risk-based fraud detection, and penetration testing to secure users, apps, and transactions. Trusted by banks and credit unions, it ensures compliance with GDPR, eIDAS, and AML while integrating easily with existing systems. Built for scalability and performance, our cloud-native architecture helps financial services prevent fraud, detect threats in real time, and deliver secure digital experiences.

Solutions that work together to defend what matters most

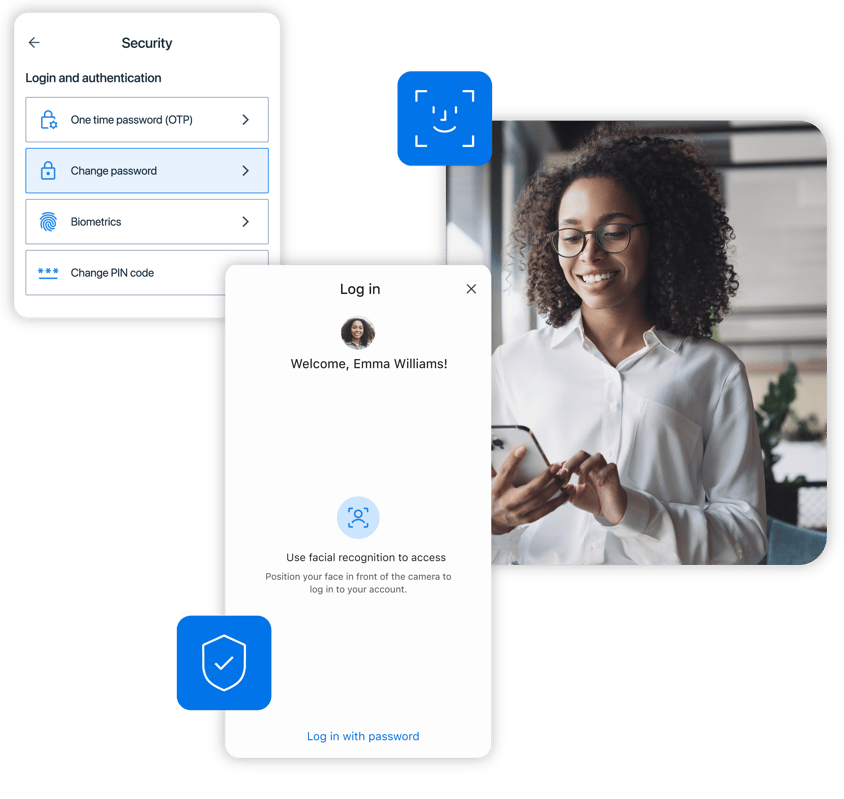

TrustFactor is a secure, passwordless MFA using biometrics and device cryptography, replacing SMS codes with context-aware transaction signing.

MPS defends mobile apps with anti-tamper, anti-hooking, and anti-debugging, securing runtime and certificates.

Our risk engine detects fraud using behavioral analytics and customizable machine learning. It generates alerts based on unusual user or device activity patterns.

A secure, eIDAS-compliant platform for legally binding EU digital signatures, integrated with KYC and TrustFactor for fraud-proof identity validation.

Fast to deploy. Simple to scale

A platform that is fast to deploy and simple to scale, with SDKs for iOS and Android, a REST API, and a cloud-native architecture. It integrates seamlessly with existing CIAM and IAM systems, supports CI/CD pipelines, and is GDPR and eIDAS-ready by design, ensuring secure, compliant, and efficient implementation across your digital ecosystem.

Want to test your app first?

Our certified security experts simulate real-world attacks on your web, mobile, and API infrastructure to uncover critical vulnerabilities before attackers do. Services include penetration testing, DevSecOps consulting, and in-depth reviews of cloud and application architectures, ensuring your systems are secure by design.

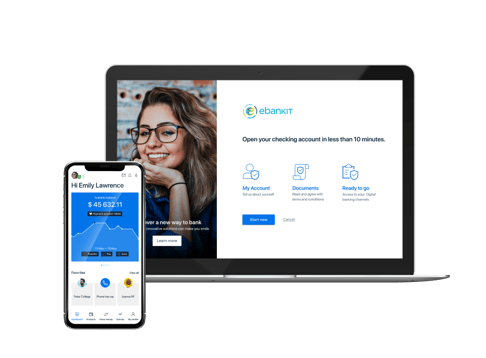

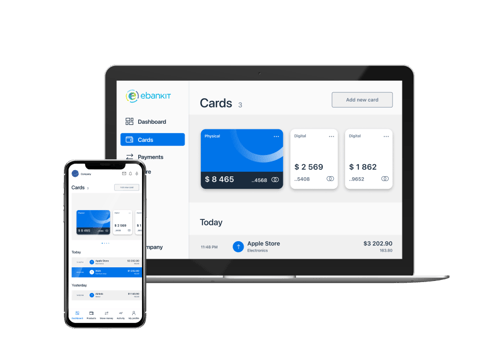

Discover a next generation banking platform that can do both

Retail banking

Loans, payments, transfers, cards, opening new accounts and much more. Discover the most innovative and personalized multichannel experience for banking customers of any age, background or level of experience.

Business banking

Designed with extensive multi-user and multi-currency capabilities, ebankIT helps banks and credit unions to provide the best guidance and widest portfolio for corporate and SME’s across every banking channel.

Secure your bank and customer data

Discover how ebankIT protects your institution and strengthens customer trust.

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)