Personalized experiences in mobile banking apps

For financial institutions, the future is personal. Customers are now demanding to be recognized as an individual through personalized offers, incentives, and messaging that show their bank not only knows and understands them - but cares about their financial well-being. By humanizing digital banking, insitutions have a golden chance to respond to the growing demand for services tailored to an audience of one. Our latest white paper will help you understand the potential of personalization and how to build deeper customer relationships.

What will you learn?

Meet the personalization pioneers who bring consumers and businesses the bespoke service they demand while achieving the scale needed for genuine market impact.

How financial institutions can leverage technology and agile practices to deliver meaningful, individualized experiences that bolster customer satisfaction and loyalty.

Explore ideas on how to tailor not just user interfaces but also underlying technology to each customer’s financial behaviors and preferences.

Key areas of focus for institutions that want to prioritize personalization to enhance satisfaction and engagement by focusing on user-friendly interactions.

Guidance on humanizing services through contextual, empathetic interactions that transform static digital channels into responsive, customer-centric platforms.

A briefing for banks on how to carry out sophisticated personalization using the rich datasets and customer trust earned as a trusted financial institution.

Your path to personalization

Personalization as a differentiator

Personalized services make customers feel understood and catered to, which boosts retention and loyalty. They also serve as a crucial differentiator in a market where fintechs and challenger banks compete for the same customer base.

Beyond meeting immediate customer expectations, personalization has the potential to guide the strategic direction of banking institutions. Insights from customer interactions can inspire new financial products, shape differentiated market positioning, and bolster competitive advantage.

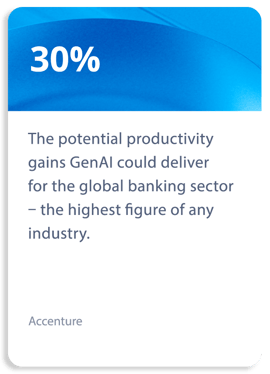

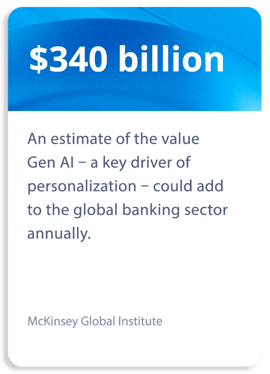

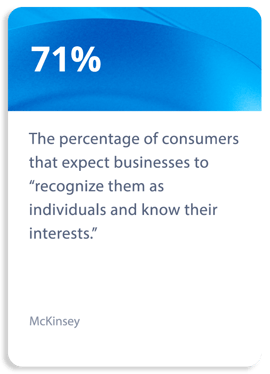

The numbers

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)