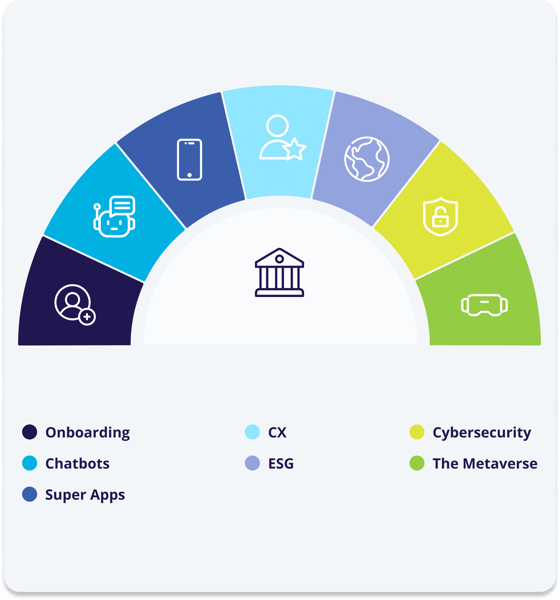

Disrupting Banking: Digital Banking Trends and Predictions for 2023

Prepare to lead the digitally-empowered financial institutions of tomorrow with our guide to the trends that will shape banking in 2023 and beyond. This report is your roadmap for the future of digital banking, revealing important trends and the technologies which will enable banks to meet changing customer demands.

What will you learn?

Onboarding can be a bank’s first interaction with a customer - and the last. Getting it right is non-optional.

Digital banking customers are predicted to spend $142 billion using chatbots by 2024. Are you ready?

Financial institutions have committed $130 trillion of assets to the net zero drive. Don’t get left behind.

One app to rule them all. Super Apps have the potential to “up-end” the banking sector, KPMG has warned.

Banks are vulnerable to cyberattacks - and the risk is growing. How to take action today by tackling insider threats.

A new reality for banks. Goldman Sachs and Morgan Stanley estimate the Metaverse economy will be worth up to $8 trillion.

Understand the digital banking trends you need to know about in 2023

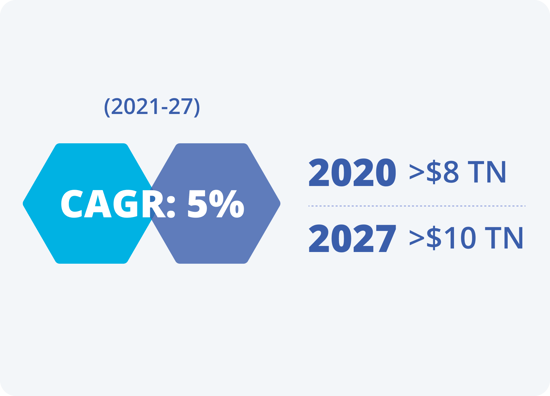

The digital banking landscape

The growth of the digital banking market will accelerate in 2024 and beyond. The size of this market grew to more than $8 trillion in 2020 and is predicted to grow by 5% between 2021 and 2027. In 2020, the total value of digital payments climbed to $750 trillion, with digital transactions soaring above $900 billion.

The numbers

As the popularity of super-apps grows, they could become a much bigger source of competition for banks than either neobanks or fintechs.

by Accenture

The future is now

This report will help innovators understand the changes that are coming to banking and prepare to lead the next generation of digitally-empowered financial institutions.

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)