Gartner® Hype CycleTM for Digital Banking Transformation, 2023

Technology innovations are empowering banks, influencing customer demand for products and services, and shaping regulators’ actions globally. Bank CIOs can use this Gartner research to spotlight innovations shaping their industry and prioritize their technology investment strategies.

Download Gartner hype cycle for digital banking transformation

What will you learn?

products

Products that react to situational

data to construct - or compose -

a loosely coupled package of components designed to address

specific customer needs.

data and APIs

Open Banking technologies are

enabling new consumption and distribution models for bank

products and services.

and payments

The integration of banking and

insurance products and services

within the core products that

customers use and consume on

a daily basis.

societal ecosystems

The connections and the data flows that are developing as machines, sensors and associated technologies are integrated into domestic and work environments.

platforms

delivery within a seamless,

consistent experience.

in Banking

Technologies that can generate

new derived versions of content, strategies, designs and methods

by learning from large repositories

of original source content.

Analysis: What you need to know

Across geographies and market sectors, banks have vastly different business and technology priorities, risk and innovation appetites, and IT and cultural maturities. There are also huge variations in customer needs, competitor activities, fintech activities and regulatory impacts. When assessing the impact of transformative digital technologies on their institutions, it is important bank CIOs consider all the variables.

The numbers

Financial services products face a reinvention. Advances in AI, data analytics capabilities and expansion in flows of contextual data from Internet of Things (IoT) and other data generating sources will influence how customers - whether human, corporation or machine - consume products in the future.

Investment strategies for CIOs

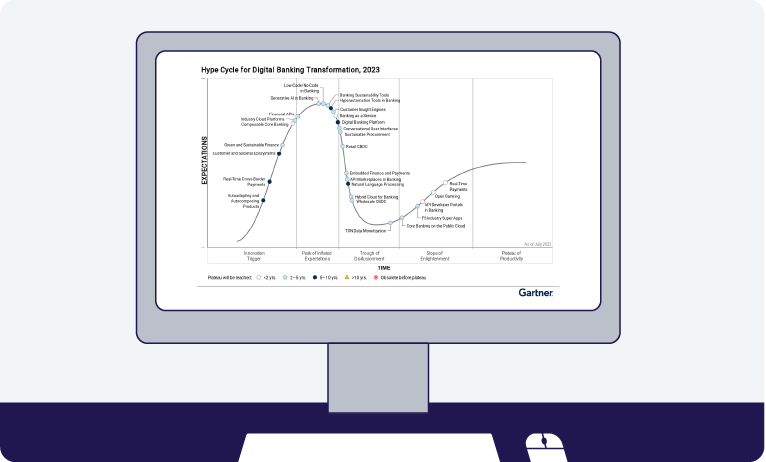

The Gartner Hype Cycle highlights a range of current technologies that are deemed truly important and impactful for the banking industry as a whole. Fifteen technologies are defined as transformational. These nascent technologies have huge potential to drive fundamental change in the banking industry.

Related articles

Gartner, Hype Cycle for Digital Banking Transformation, 2023, Alistair Newton, 20 July 2023.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, and HYPE CYCLE is a registered trademark of Gartner, Inc. and/or its affiliates and are used herein with permission. All rights reserved.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from Ebankit.

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)